How to maximize your tax benefits with the FEIE Standard Deduction

Wiki Article

The Foreign Earned Income Exemption Explained: A Guide to Enhancing Your Conventional Deduction

The Foreign Earned Revenue Exclusion (FEIE) is a crucial tax obligation stipulation for united state residents and resident aliens living abroad. It allows eligible migrants to leave out a considerable part of their foreign-earned earnings from government taxes. Understanding the nuances of FEIE can result in substantial tax financial savings. However, several individuals ignore important details that might affect their eligibility and benefits. Checking out these facets may expose chances for boosted tax end results.Understanding the Foreign Earned Earnings Exemption

Numerous expatriates look for opportunities abroad, understanding the Foreign Earned Earnings Exemption (FEIE) is necessary for handling their tax obligation obligations. This arrangement allows U.S. citizens and resident aliens living overseas to leave out a particular amount of their earned revenue from government taxation. The FEIE was established to reduce the tax obligation worry on individuals that stay outside the USA, recognizing the distinct economic challenges they might face.

Qualification Requirements for FEIE

Exactly how to Claim the FEIE

To successfully claim the Foreign Earned Income Exemption (FEIE), taxpayers need to initially confirm their qualification based upon specific requirements - FEIE Standard Deduction. The procedure includes numerous steps, consisting of submitting the ideal forms and giving necessary paperwork. Understanding these treatments and requirements is necessary for making best use of tax advantages while living abroadQualification Requirements

Eligibility for the Foreign Earned Earnings Exemption (FEIE) depends upon conference particular standards established by the IRS. To qualify, people must be U.S. residents or resident aliens that gain income while working abroad. They need to develop a foreign tax home, which implies their primary business is outside the United States. Furthermore, candidates have to meet either the Bona Fide Home Examination or the Physical Existence Examination. The Bona Fide Residence Examination calls for that a taxpayer stays in a foreign country for an entire tax obligation year, while the Physical Visibility Examination necessitates costs at the very least 330 complete days in an international nation throughout a 12-month duration. Satisfying these needs is vital for claiming the FEIE.Filing Process Steps

How can one efficiently navigate the procedure of declaring the Foreign Earned Earnings Exclusion (FEIE)? People must establish their qualification based on the physical visibility examination or the bona fide home test. Once validated, they need to finish internal revenue service Kind 2555, which information international earnings and residency. This form has to be affixed to their yearly income tax return, typically Kind 1040. It is necessary to precisely report all foreign made income and guarantee conformity with the IRS guidelines. Furthermore, taxpayers ought to maintain appropriate documents, such as foreign income tax return and proof of residency. By following these actions, individuals can efficiently declare the FEIE and potentially reduce their gross income considerably, boosting their general financial setting.Calculating Your International Earned Income Exclusion

While several expatriates look for to maximize their economic benefits abroad, understanding the computation of the Foreign Earned Income Exemption is vital for exact tax coverage. The Foreign Earned Income Exemption allows certifying people to leave out a certain amount of their foreign profits from U.S. tax, which is adjusted annually for inflation. To compute this exclusion, expatriates need to determine their overall international made revenue, which normally includes earnings, salaries, and expert costs made while staying in a foreign country.Next off, they need to finish IRS Type 2555, supplying information about their foreign residency and work condition. FEIE Standard Deduction. It is very important to fulfill either the bona fide house test or the physical presence test to get approved for the exemption. As soon as these factors are established, the maximum permitted exclusion amount is applied, minimizing the person's taxable income significantly. Precise computations can cause substantial tax obligation cost savings for migrants living and functioning abroad

The Influence of FEIE on Various Other Tax Benefits

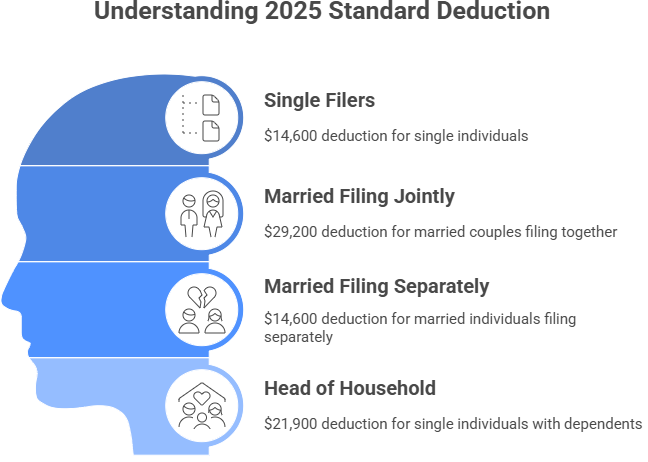

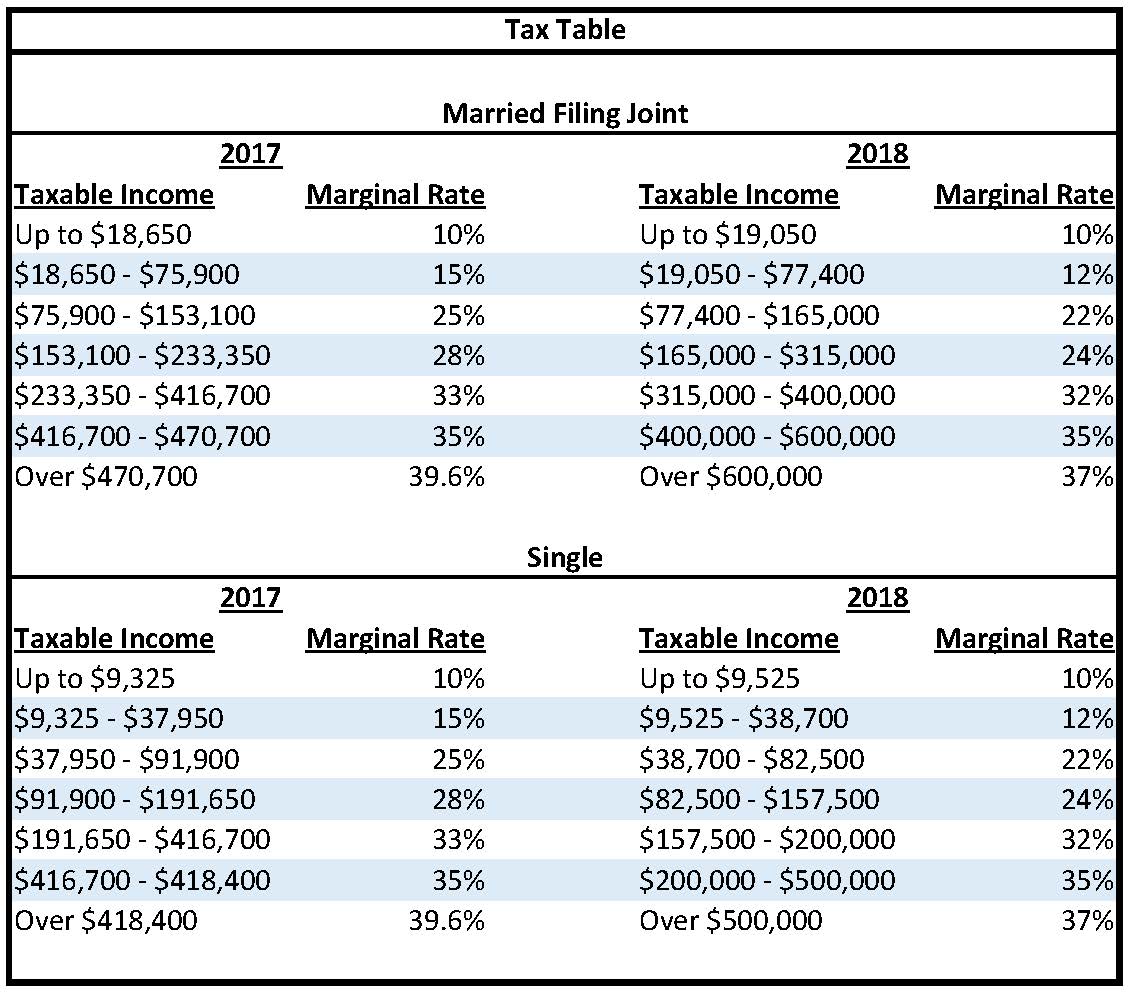

The Foreign Earned Income Exemption (FEIE) can influence a person's qualification for certain tax benefits, including the basic deduction. By omitting foreign made earnings, taxpayers might discover their modified gross earnings affected, which in turn can impact their qualification for various tax credit ratings. Comprehending these interactions is important for enhancing tax outcomes while living abroad.Communication With Requirement Deduction

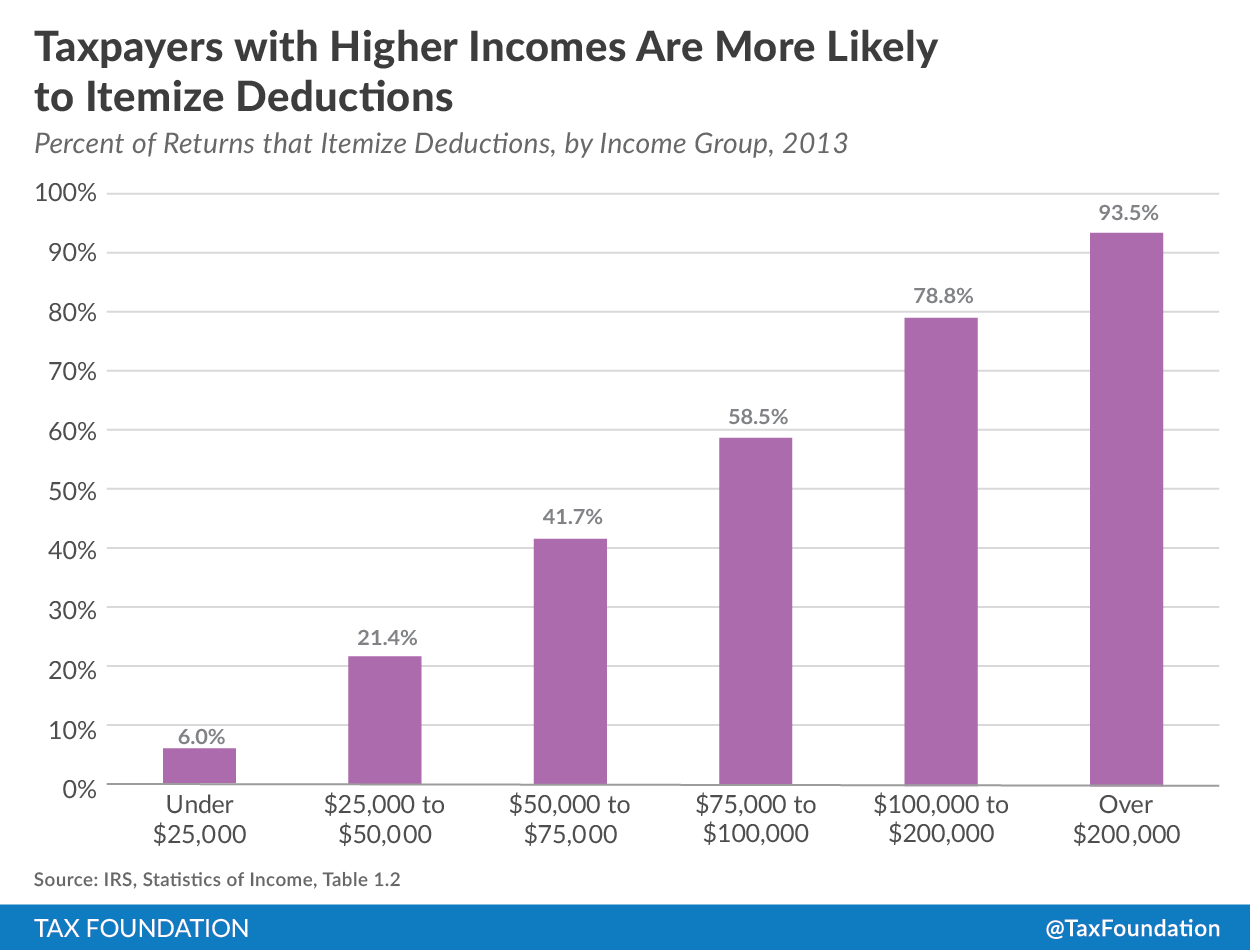

When individuals get the Foreign Earned Revenue Exemption (FEIE), their qualification for the common deduction may be affected, possibly changing their overall tax obligation obligation. The FEIE enables taxpayers to exclude a certain amount of made earnings from united state taxes, which can lead to a reduced taxed earnings. Therefore, if the excluded revenue surpasses the basic reduction, it can reduce the benefit of asserting that deduction. Additionally, taxpayers that use the FEIE may find that their ability to itemize deductions is additionally influenced, as particular costs might be affected by the exclusion. Understanding this communication is necessary for expatriates to optimize their tax advantages while guaranteeing conformity with U.S. tax lawsQualification for Tax Credit Scores

Guiding through the intricacies of tax obligation credit reports can be challenging for expatriates, especially considering that the Foreign Earned Income Exemption (FEIE) can substantially affect qualification for these advantages. The FEIE allows qualified individuals to leave out a significant part of their international earnings from U.S. tax, yet this exemption can additionally impact accessibility to different tax obligation credit ratings. For example, taxpayers who make use of the FEIE may find themselves ineligible for debts like the Earned Income Tax Credit Score (EITC), as these credit histories commonly require gross income. In addition, the exclusion may limit the ability to claim certain reductions or debts linked with dependents. Understanding the interaction in between the FEIE and available tax credit scores is important for migrants intending to enhance their tax situation.

Typical Blunders to Avoid When Declaring FEIE

Generally, expatriates experience numerous pitfalls while claiming the Foreign Earned Earnings Exemption (FEIE), which can lead to expensive mistakes or missed out on possibilities. One frequent mistake is stopping working to satisfy the physical visibility or authentic residence test, which is vital for qualification. Additionally, expatriates commonly overlook the requirement to file Form 2555 correctly, resulting in unreliable or insufficient entries.An additional see this page usual mistake entails inaccurately determining international made revenue, as lots of do not represent all appropriate earnings resources. Some migrants incorrectly presume they can omit all their earnings, uninformed of the restrictions on the exclusion amount. Disregarding to keep appropriate paperwork, such as travel days and residency standing, can endanger an insurance claim. Misconstruing the ramifications of the FEIE on various other tax obligation credit scores may lead to unintentional tax obligation obligations. Recognition of these risks can help with a smoother asserting process and take full advantage of potential advantages.

Resources for Expats Navigating U.S. Tax Obligations

Navigating web link U.S. tax obligation obligations can be testing for expatriates, specifically after running into challenges in claiming the Foreign Earned Earnings Exemption (FEIE) To assist navigate these intricacies, a range of sources are available. The IRS web site offers considerable information on tax obligation kinds, regulations, and faqs particularly customized for migrants. Additionally, organizations like the American Citizens Abroad (ACA) and the Deportee Tax Professionals offer advice and support to ensure conformity with tax obligation legislations.Online online forums and areas, such as the Deportee Forum, enable expatriates to share experiences and understandings, cultivating a supportive environment for those facing similar difficulties. Tax preparation software, like copyright and H&R Block, frequently includes functions developed for expats, making the declaring procedure extra straightforward. Involving with these sources can encourage migrants to much better comprehend their tax responsibilities and maximize advantages like the FEIE.

Regularly Asked Concerns

Can I Declare FEIE if I'M Freelance Abroad?

Yes, self-employed individuals abroad can assert the Foreign Earned Revenue Exemption (FEIE) To qualify, they should meet specific requirements regarding residency and income, guaranteeing they abide by IRS guidelines for migrants.

Is the FEIE Applicable to Foreign Pensions?

The Foreign Earned Earnings Exclusion (FEIE) is not relevant to international pension plans. Pension plans are thought about unearned income and do not get the exemption, which specifically relates to made revenue from employment or self-employment abroad.What Happens if I Go Back To the U.S. Mid-Year?

If a specific returns to the united state mid-year, they may require to adjust their tax scenario. Their qualification for particular reductions and exemptions, consisting of the Foreign Earned Earnings Exclusion, can be affected by their residency condition.Can FEIE Be Claimed With Other Reductions?

Yes, the Foreign Earned Revenue Exclusion (FEIE) can be claimed along with other deductions. Care should be taken to guarantee appropriate compliance with tax laws, as certain restrictions might use based on individual scenarios.How Does FEIE Impact State Tax Obligation Obligations?

The Foreign Earned Income Exemption can lower a taxpayer's federal income tax obligation liability, however it does not instantly influence state tax responsibilities, which differ by state and might still call for reporting of foreign income.Lots of migrants seek possibilities abroad, comprehending the more information Foreign Earned Revenue Exemption (FEIE) is vital for handling their tax obligation commitments. By excluding foreign gained income, taxpayers may find their adjusted gross earnings impacted, which in turn can affect their certification for different tax obligation credit scores. Guiding through the intricacies of tax credit histories can be testing for expatriates, specifically given that the Foreign Earned Revenue Exclusion (FEIE) can considerably affect eligibility for these benefits. Taxpayers who make use of the FEIE might locate themselves ineligible for credit scores like the Earned Revenue Tax Obligation Credit Rating (EITC), as these credit reports normally need taxable income. Steering United state tax obligations can be testing for migrants, particularly after encountering pitfalls in asserting the Foreign Earned Earnings Exclusion (FEIE)

Report this wiki page